An earlier version of this article appeared last Friday in Family Wealth Report, sister news service of this one. It comes from , the consultancy working with firms catering for high net worth and ultra-HNW clients. The US-based business charts the technology driving the North American and global wealth management sector. The insights from this article also apply outside the US, which is why we want to run this article in Asia and Europe.

The editors of this news service are pleased to share these thoughts and invite readers to respond. Jump into the conversation! The usual disclaimers apply to content from outside contributors. Email tom.burroughes@wealthbriefing.com and jackie.bennion@clearviewpublishing.com

It’s already well past halfway through the year and planning for 2021, and beyond, is in full swing. Our F2 Strategy Research team connected with an elite group of the leading wealth tech decision-makers in the industry. We discussed how they plan to pivot into a new age of strategic planning during a pandemic which looks as though it will ultimately change the way we run our businesses for years to come.

On a high level: Most firms will increase their tech spend as they work out ways to enhance their digital client experience, embed digital into the foundation of business growth and fix problem areas when it comes to project execution.

Below are the 5 big trends that are coming out of these early stages of planning:

Trend 1: Tech spend increases to “keep up” rather than “get ahead” of the competition next year

In 2021, 81 per cent of firms expect to increase their tech budget by more than 5 per cent over 2020. Post-COVID-19, boards have clearly committed to spending more on tech, but it's the reason why they are spending more that’s surprising. Many firms say that the main driver of their increase in tech spending is primarily based on keeping up with competition and client expectations versus exceeding them and achieving growth. In addition, the predominant focus on tech growth is on improving experiences, including improving digital, frictionless client/advisor experiences, integrating platforms and ensuring scalability/growth support.

Unlike prevous years, increased tech spend is now critical to the survival of the company. Firms must spend wisely and have good counsel to maintain their...

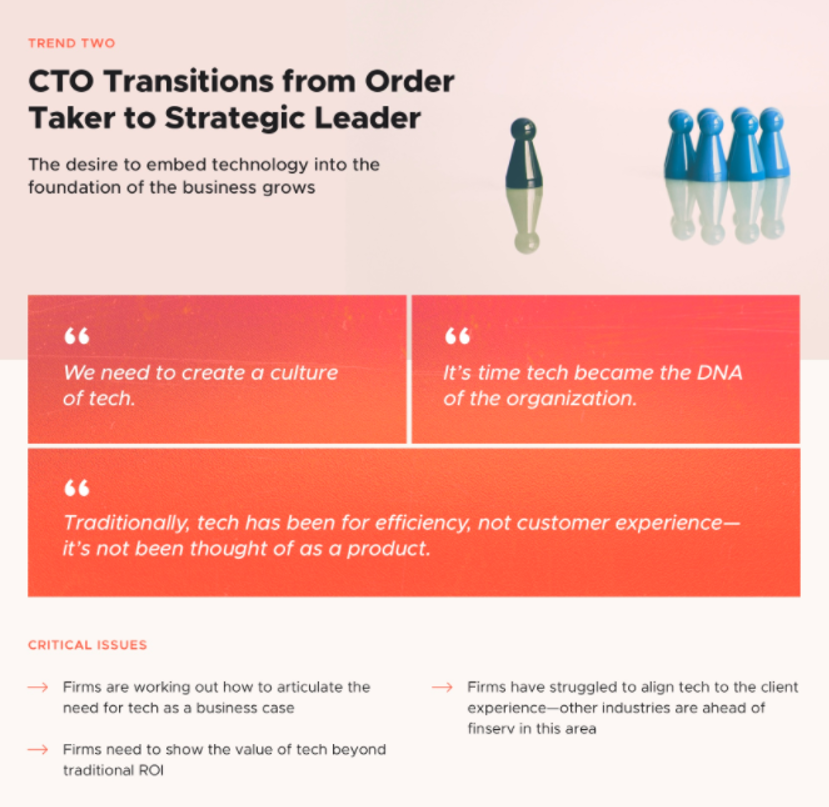

Trend 2: CTO transitions from order taker to strategic leader

This is the moment when the role of chief technology officer will become that of a strategic leader. Firms are working out how to articulate the need for tech as a business case. It is clear that they need to show the value of tech beyond traditional ROI like never before. Historically, firms have struggled to align tech with the client experience. Other industries are ahead of financial services when it comes to aligning with client expectations and they could be sources of inspiration.

Trend 3: Firms see digital experience as a cornerstone for innovation

Planned priority areas show that future client experiences will be increasingly digitally interactive and on demand. Firms expect that for tech enhancements to lead they need to be more diverse to appeal to global client bases. It’s important to note, history shows, that after a disruption comes a period of transition; therefore firms should act now to improve marketing and branding to prepare for the transition or risk being left behind.

Trend 4: The biggest unknown - will the economy be a roadblock for five-year visions?

The economy. What lies ahead is anyone’s guess. Firms, still reeling from the sudden instability caused by the pandemic and it’s largely unknown long-term impact, question whether it makes sense to plan five years out anymore. This economic uncertainty is a potential roadblock to planning appropriate staffing, large investments in tech and the capacity to take on multiple transformative projects. In addition to the economic uncertainty, firms see other concerns that could derail five-year visions, including the future regulatory environment, merger and acquisitions and changes to competitive landscape and unanticipated disruptive technology.

Trend 5: No lack of blame - firms fixing many problem areas to improve project execution

While reasons for project execution missing the mark vary by firm size across the board, firms cite the need to address poor training and adoption. Firms also say that communication and transparency between tech groups and business groups are the keys to improving project execution. In addition, speed is lacking - only 14 per cent of firms fund tech projects within two weeks; 47 per cent take more than three months. The question is, can agile firms do it better? And if so, what should everyone learn from them?